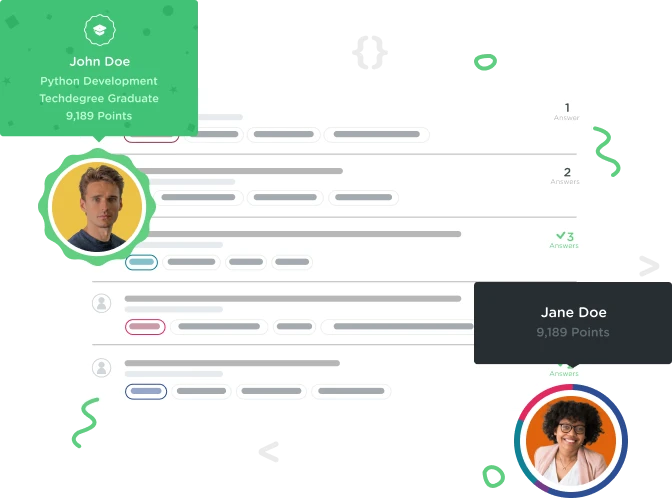

Welcome to the Treehouse Community

Want to collaborate on code errors? Have bugs you need feedback on? Looking for an extra set of eyes on your latest project? Get support with fellow developers, designers, and programmers of all backgrounds and skill levels here with the Treehouse Community! While you're at it, check out some resources Treehouse students have shared here.

Looking to learn something new?

Treehouse offers a seven day free trial for new students. Get access to thousands of hours of content and join thousands of Treehouse students and alumni in the community today.

Start your free trial

Malachai Frazier

7,399 PointsCosts per share

When incorporating (Delaware), do I really have to pay out of pocket for founder shares in the onset? Can't I just charge them to 'sweat equity'?

3 Answers

Pasan Premaratne

Treehouse TeacherHey Malachai,

Simple answer, no. There's tax implications with owning founders stock because it is an asset that has a market value. If price is the consideration, you can set the par value of each share so low that it costs very little for you to own the stock.

Here's a good article to read for more information.

Malachai Frazier

7,399 PointsI understand. Thanks for the info!

Pasan Premaratne

Treehouse TeacherGlad I could help :)